Nonprofit organizations are navigating one of the most challenging operating environments in recent years. With diminishing federal funding, rising operating costs and increasing demand for services, leaders are under growing pressure to balance mission with financial resilience.

The Grassi 2025-26 Nonprofit Leadership Report, based on responses from more than 200 nonprofit leaders, reveals an industry striving to sustain critical services and build long-term stability in an uncertain economic landscape. The findings highlight key strategies that shaped nonprofit decision-making throughout 2025 and will continue to influence organizational priorities into 2026.

Nonprofit Industry Outlook: Rising Demand, Increased Costs and Funding Volatility

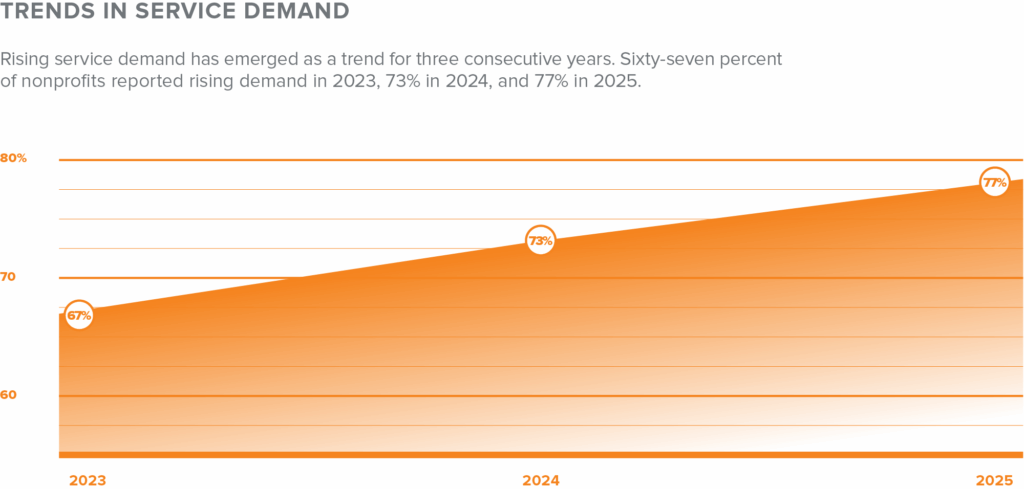

Economic pessimism is on the rise among nonprofit leaders, with 44% anticipating worsening conditions over the next year. This marks a notable shift from the 2024 report, when just 28% of leaders expected the economy to decline. For the third year in a row, demand for services rose, with 77% of organizations reporting cost increases averaging 13-15% — more than five times the current inflation rate.

Shifts in overall funding were inconsistent across the sector:

- 44% of organizations reported increases

- 29% reported decreases

- 25% reported no change

- 2% were unsure

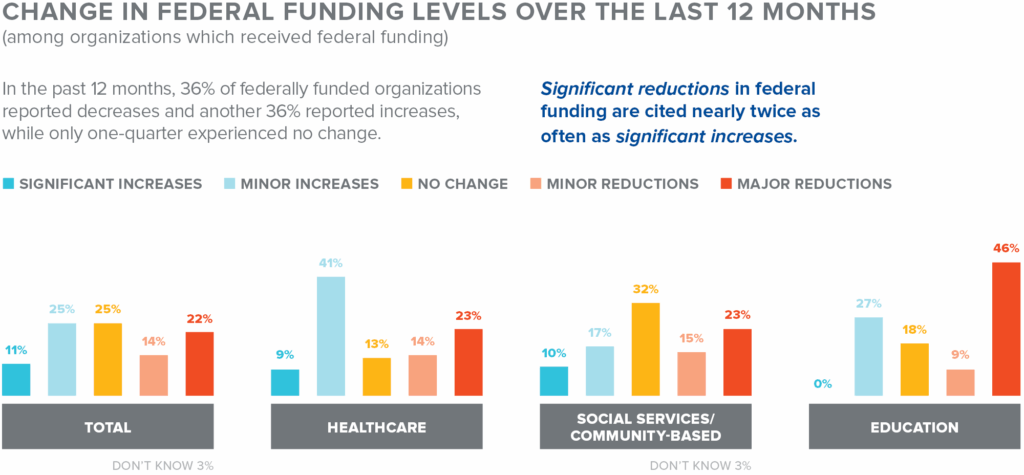

More than half of the leaders surveyed said their organization relies on federal funding. While 36% of organizations reported increases in federal funding and an equal percentage cited decreases, “significant decreases” were mentioned nearly twice as often as “significant increases.”

Financial Resilience Strategies for Nonprofit Leaders

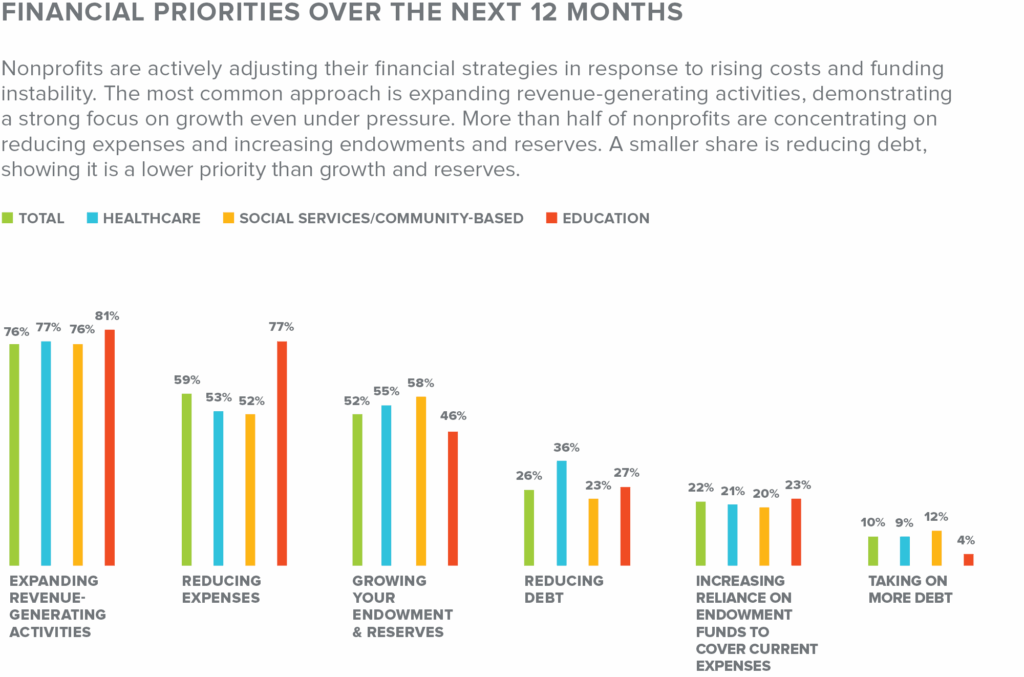

As funding becomes less predictable and budgets tighten, organizations are often expected to absorb the impact, and leadership must make difficult decisions around resource allocation and cost management. These leaders are seeking new, creative strategies to optimize their financial position, diversify revenue streams and build cash reserves:

- Reallocating existing funds: Redirecting resources toward programs with the highest mission impact, while scaling back initiatives that no longer align with organizational priorities

- Increasing fundraising efforts: Broadening donor engagement through digital giving, corporate partnerships and new fundraising campaigns

- Expanding revenue streams: Pursuing new funding opportunities and mission-aligned partnerships to diversify income

- Reducing expenses: Identifying redundancies in spending while reviewing administrative, technology and utility costs

- Building reserves and endowments: Strengthening both short-term resilience and long-term sustainability by setting aside unrestricted funds and investing in future income

When new funds become available, many organizations reinvest in program expansion and workforce development to strengthen mission delivery. Even in this challenging climate, more than three-quarters of nonprofit leaders remain committed to expanding revenue-generating activities, underscoring a sustained focus on growth and long-term mission sustainability.

Leadership Priorities Amid Workforce and Labor Pressures

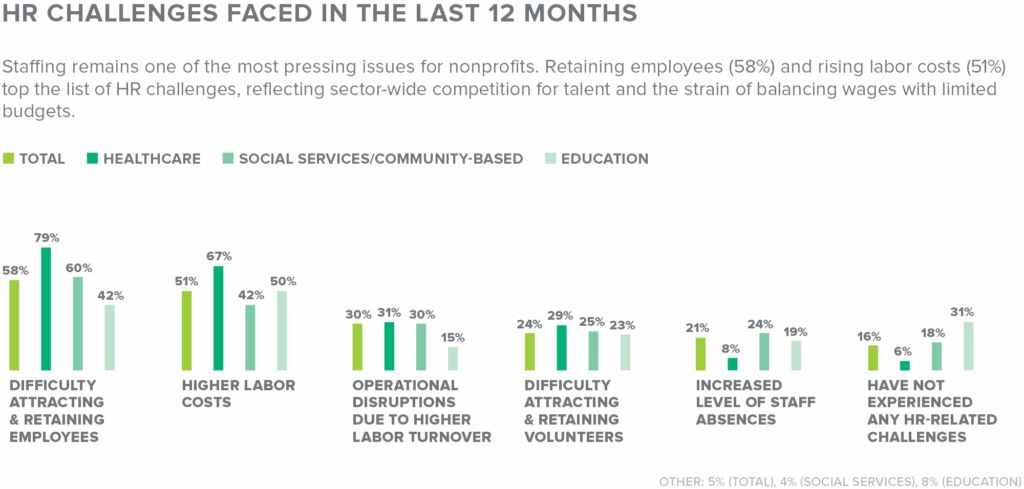

Human capital can be a nonprofit’s most important asset and most significant cost, often accounting for 75-85% of the total budget. Across the sector, nonprofit leaders are seeking new operational efficiencies and technological accelerators to help staff increase productivity without experiencing burnout.

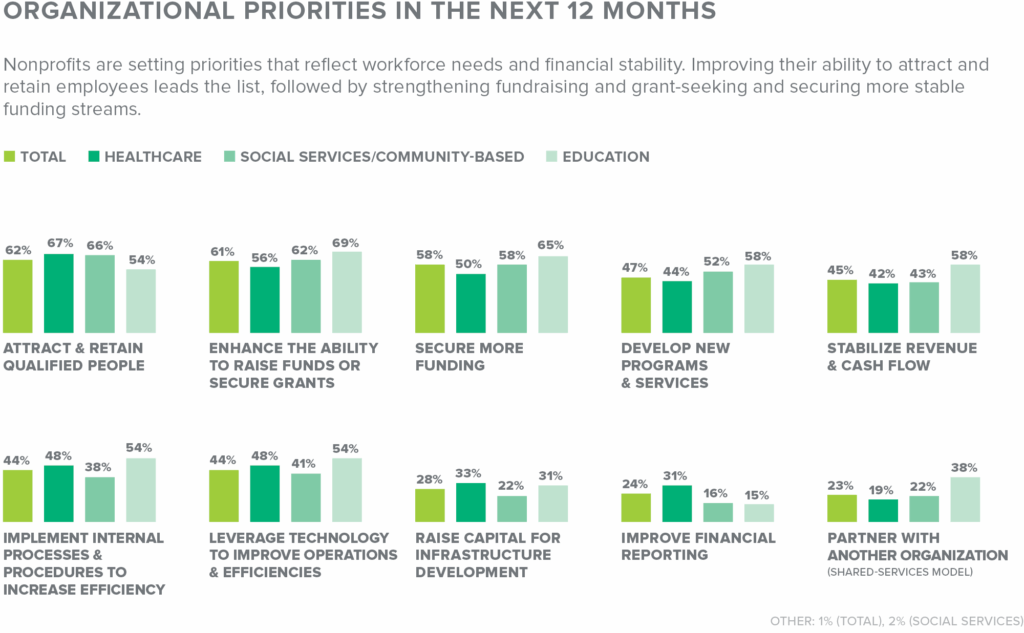

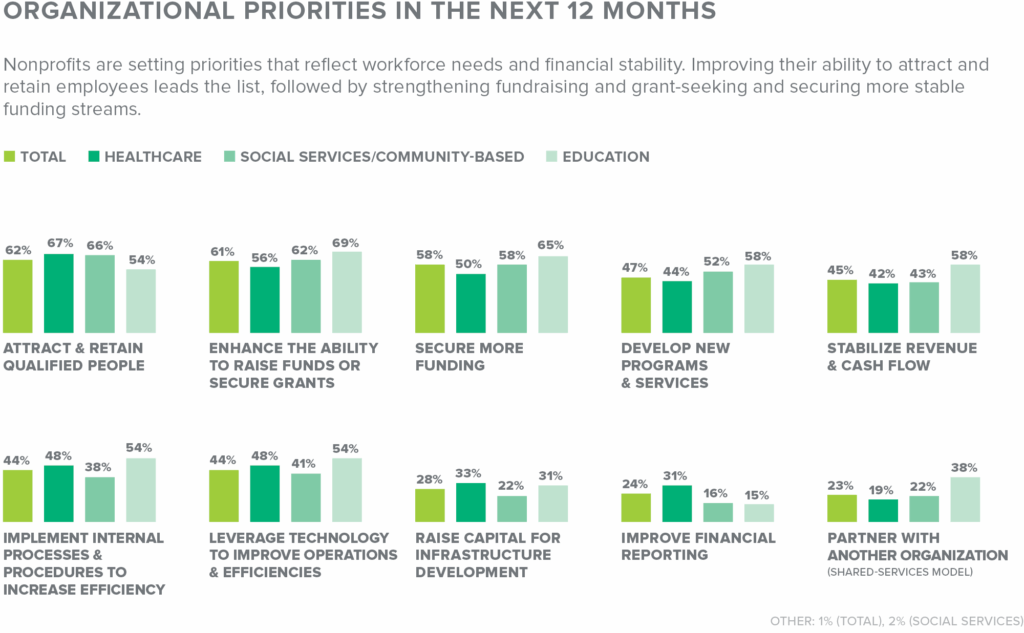

Sixty-two percent of leaders cite recruitment and retention as a top priority, demonstrating a clear connection between a strong workforce and effective mission delivery. For the year ahead, nonprofit leaders are prioritizing talent attraction and retention, followed by strengthening fundraising and improving operational efficiency. Many are investing in internal processes, technology and leadership development initiatives to reduce turnover and prepare for internal talent pipelines to thrive as future leaders.

The Critical Imperative of Nonprofit Board Engagement

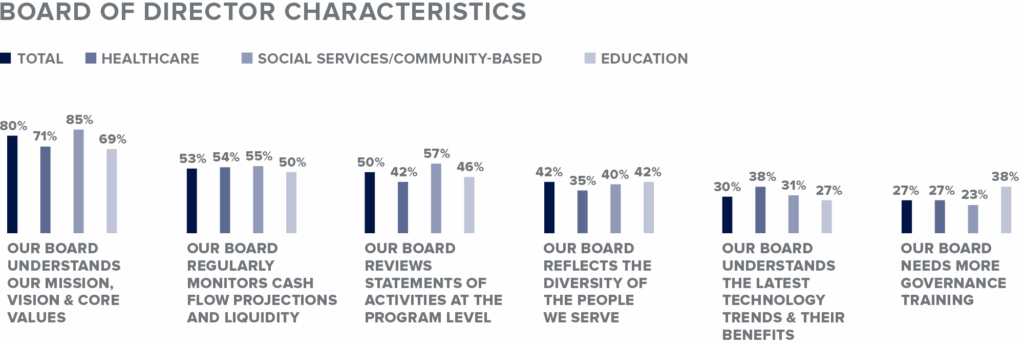

Boards are true stewards of the mission, often deeply invested in the mission as they guide strategy and oversee accountability and decision-making. When boards are fully engaged, the organization is more likely to be aligned with purpose and positioned for future growth. The report highlights a strong involvement across most boards, but with varying levels of engagement in key governance areas:

- Mission alignment: Eighty percent of boards understand the organization’s mission, vision and values.

- Financial oversight: Just over half monitor cash flow and liquidity, and only about half monitor statements at the program level.

- Diversity and innovation: Boards have room to improve, with only 42% reflecting the diversity of the communities they serve and 30% understanding the latest technological trends.

- Training: Twenty-seven percent of leaders believe their boards would benefit from additional governance education.

Financial and technical acumen are critically linked to board engagement, with highly engaged boards six times more likely to have a strong financial understanding and four times more likely to understand the latest technological advancements. These findings emphasize the critical imperative of active participation, diverse perspectives and shared responsibility for achieving the mission.

Strengthening Succession Planning and Leadership Development Pipelines

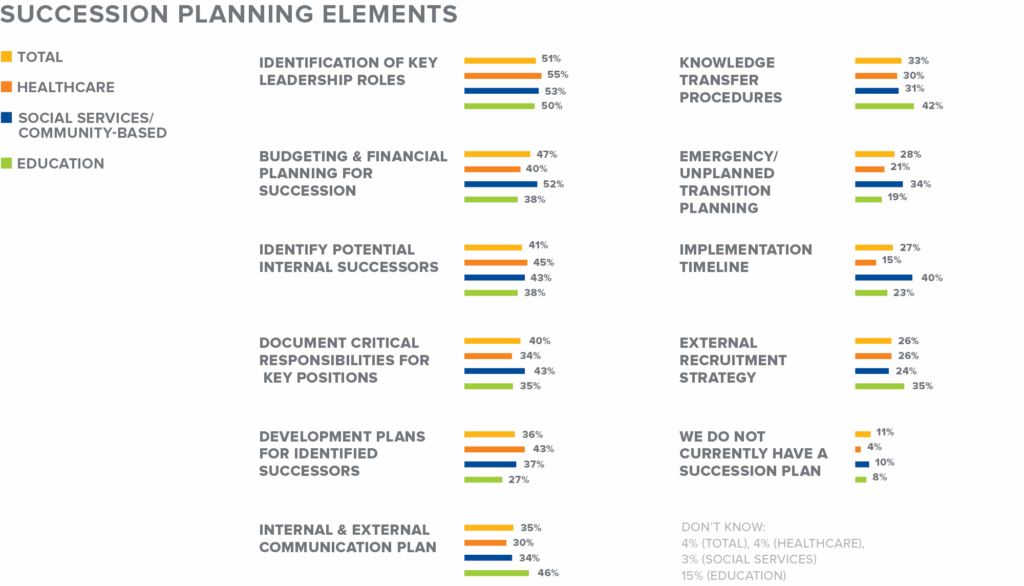

With leadership often holding many of the organization’s most important relationships and institutional knowledge, the departure of a key executive — whether expected or unexpected — can jeopardize service delivery, fundraising and overall organizational stability.

Despite this risk, many nonprofit organizations remain underprepared for major leadership transitions. Common barriers include limited internal talent pipelines, other competing short-term priorities and insufficient board involvement in succession planning. Nearly one in ten organizations has no plan in place at all, and among those that do, only about half have identified successors for key leadership roles. To address these gaps, organizations are focusing on the following strategies:

- Documenting key responsibilities: Capturing critical processes and leadership knowledge to reduce disruption during transitions

- Developing internal talent: Investing in professional development, mentoring and cross-training to build leadership capacity from within

- Engaging the board: Involving board members early in identifying successors and aligning leadership transitions with mission and strategy

- Assessing readiness: Reviewing organizational charts, role dependencies and leadership tenure to anticipate future needs

When organizations invest in leadership development, especially internally, they can build confidence and continuity both inside and outside of the organization. By combining strategic planning with a commitment to developing internal talent, nonprofits can transform leadership transitions into opportunities for growth and resilience.

Digital Innovation and Technology Priorities for Nonprofits

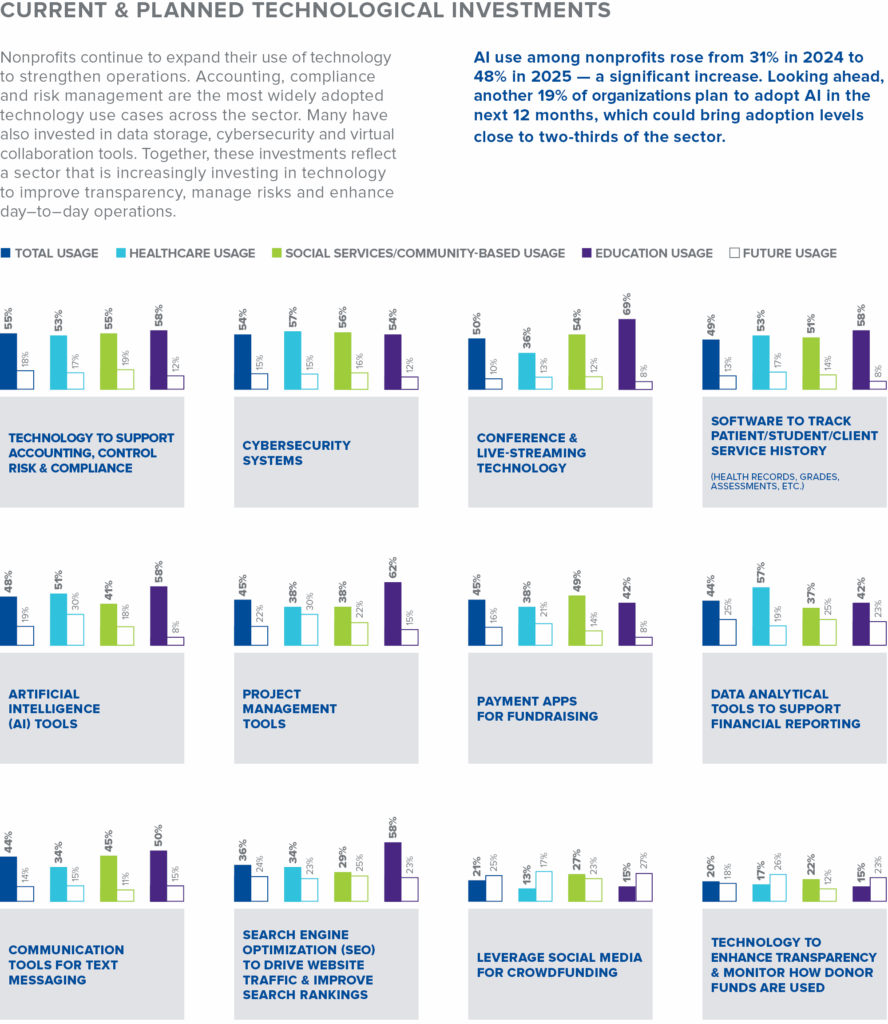

Nonprofit leaders are implementing technology to redefine how they operate internally, communicate with donors and deliver services to the community. Technology investment remains a top investment priority across the sector, particularly in advanced data analytics, AI and cybersecurity.

- Data as the foundation

Many organizations view data as the infrastructure that supports transparency, efficiency and strategic decision-making. Tools for accounting, compliance and financial reporting help build the foundation for stronger analysis and forecasting. By strengthening data systems, nonprofits are gaining insights that improve operations and support mission outcomes. - AI adoption accelerating

AI adoption has risen sharply across all organization types. Forty-eight percent of nonprofits now use AI, up from 31% the previous year. Organizations cite use cases such as automating administrative tasks and analyzing donor or program data, freeing up their staff for high-value mission work. - Cybersecurity as a growing priority

As the implementation of digital tools grows, so does exposure to risk. Only 38% of nonprofit leaders are “very confident” in their ability to protect sensitive data, though many are prioritizing cybersecurity, recognizing that innovation and protection must advance together.

Nonprofit leaders cite accounting, compliance and risk management as the most widely adopted use cases across the sector. Other use cases of note include conference and live-streaming technologies, software to track service history, project management tools and communication tools. Together, these investments reflect a sector that is increasingly investing in technology to improve transparency, manage risk and enhance day-to-day operations.

Benchmarking for Transparency and Performance

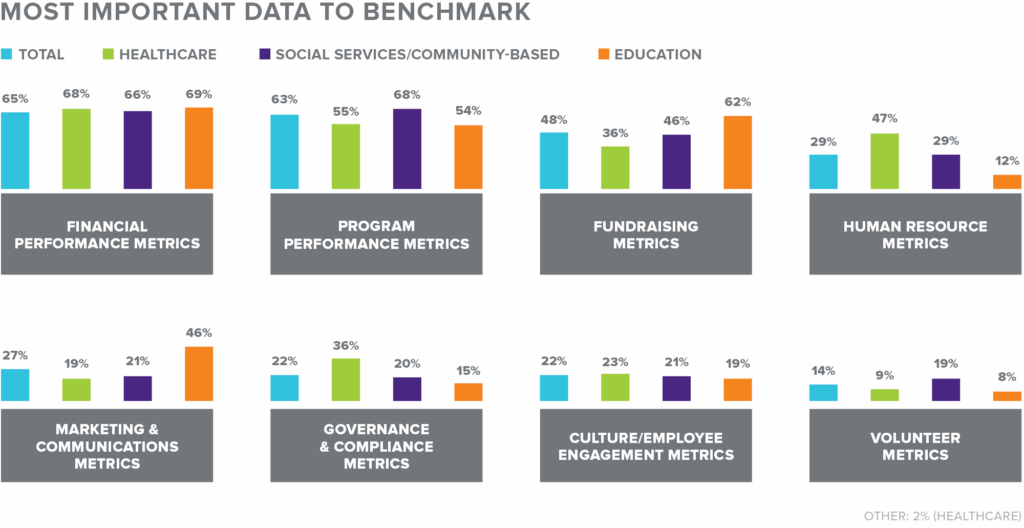

Benchmarking is increasingly recognized as one of the most powerful tools for leaders to evaluate performance and guide decision-making. Amid a more competitive funding environment, more than half of organizations now use comparative data to measure effectiveness.

Benchmarking priorities vary across the sector:

- Education organizations focus most on fundraising and marketing metrics

- Healthcare organizations emphasize governance and workforce benchmarks

- Social services/community-based organizations prioritize program performance and volunteer engagement

Benchmarking doesn’t need to be about comparison; it can be an effective way to foster collaboration and continuous improvement across the sector. By sharing insights and results, nonprofits can leverage one another as valuable resources, learning from peers and uncovering where they can improve and better align their missions with available resources.

Charting a Path Forward for Nonprofit Leadership

In the volatile funding and economic environment, nonprofit leaders are redefining what it means to be resilient and innovative. The most effective organizations are shifting away from reactive, day-to-day management and placing greater emphasis on long-term strategic planning.

Key strategies shaping the path ahead:

- Investing in people: Building skills and leadership capacity while supporting staff wellbeing

- Diversifying funding: Expanding revenue through technology, data insights and creative fundraising models

- Strengthening governance: Engaging boards in financial oversight, strategy and accountability

- Leveraging technology: Streamlining systems and data to drive efficiency and informed decisions

The nonprofit leadership report reveals a sector defined by adaptability and perseverance in the face of challenge. By focusing on financial stability, workforce development and data-driven decision-making, leaders can chart a sustainable path forward — one that keeps mission and community at the center of every decision.

Download the Grassi 2025-26 Nonprofit Leadership Report

The Grassi 2025-26 Nonprofit Leadership Report is a valuable resource for nonprofit leaders, offering data-driven insights across sectors. Download the report or watch the webinar recap today to learn about the strategies leaders are adopting to build more resilient and sustainable organizations.

To discuss these findings and explore how Grassi’s Nonprofit advisors can help strengthen your organization’s long-term strategy, connect with our team today.