As organizations continue to look for ways to save costs amid pricing increases and other inflationary pressures, many overlook opportunities hidden in their employee benefit plans. For certain organizations, taking advantage of applicable provisions and rules can save valuable money, time and resources.

The 80/120 Rule

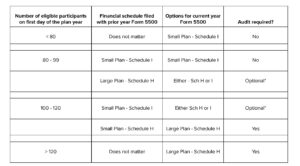

The Employee Retirement Income Security Act (ERISA), which governs the majority of defined benefit and contribution plans (”plan”) in the U.S., contains the 80/120 rule. This provision allows certain pension plans with 80-120 participants to avoid the annual audit requirement, saving these smaller plans from additional costs and administrative burdens. The below chart outlines eligibility parameters.

*Audits are always required if you elect to file as a large plan using Schedule H. Electing to file as a small plan using Schedule I will void the audit requirement.

In recent years, there have been a number of changes to the 80/120 rule that your organization should keep in mind if it attempts to qualify for it.

In 2019, the Department of Labor (DOL) updated the rule to clarify that the number of participants used to determine whether a plan is eligible for the exemption is the number of participants with account balances as of the first day of the plan year. This change was made to address concerns that plans were gaming the system by adding and then dropping participants to stay under the 120-participant threshold. This change is effective for plan years beginning January 1, 2023.

The impact of this change can be seen in the following examples:

Example 1. At January 1, 2023 the Plan has 140 eligible participants and 105 participants with account balances

Under both the old rules and the new rules, the plan would require an audit as the prior plan year would have required the filing of a Schedule H and an audit.

Example 2. At January 1, 2023 the Plan has 140 eligible participants and 99 participants with account balances

Under the old rules, the plan would have required an audit; under the new rules the plan has the option to file a schedule I, thereby removing the audit requirement.

Example 3. At January 1, 2023 the Plan has 140 eligible participants and 75 participants with account balances

Under the old rules, the plan would have required an audit, under the new rules the plan is required to file a schedule I and therefore has no audit requirement.

The new rules count individuals who are eligible to participate even if they have not elected to participate and do not have an account in the plan.

For plan years beginning on or after January 1, 2023, participant count for the audit waiver will be based on the number of participants with account balances at the beginning of the plan year. This change is intended to reduce the number of plans that need to have an audit, lower expenses for small plans and encourage more small employers to offer workplace retirement savings plans to their employees.

Depending on the size of your organization, you may want to consider ways to lower the participant count in your 401(k) plan to fall within the 80/120 threshold. Here are some of the most common methods:

- Offer a one-time cash-out opportunity for small balances. This allows participants with small balances to cash out their accounts and take the money in cash. This can be a good option if you have a large number of participants with small balances. Employees should consult with a financial advisor before making this decision.

- Increase the vesting schedule. This means that participants will have to work for your company for a longer period of time before they are fully vested in their 401(k) accounts. This can limit the number of employees participating in the plan.

- Change the contribution limits. You can reduce the maximum amount that employees can contribute to their 401(k) accounts. This may make alternative retirement strategies more attractive to some employees.

Small Balance Cash Out Provisions

Small balance cash out provisions are a set of rules that allow pension plans to automatically cash out the accounts of participants with small balances who are no longer employed by the participating employer. These provisions are designed to reduce the administrative burden of managing small accounts and to help participants easily access their retirement savings. They can also help keep your participant count within the 80/120 rule.

The specific rules for small balance cash outs vary from plan to plan, but they typically allow plans to cash out accounts with a balance of $7,000 or less. In some cases, plans may also be allowed to cash out accounts with a balance of $1,000 or less. However, an active employee who is continuing to contribute to the plan may not be able to cash out of the plan, unless they are retiring, separating from service, or becoming disabled.

There are pros and cons to small balance cash out provisions. On the one hand, these provisions can reduce the administrative burden of managing small accounts and help participants access their retirement savings more conveniently. On the other hand, these provisions can result in participants losing money in taxes and penalties, if they take the balance in cash instead of rolling it over into an IRA or another qualified retirement plan.

Considerations when making changes to your plan

The decision to lower your participant count in a 401(k) plan is a complex one, and you should carefully consider all of the implications before making a decision. Here are some factors to keep in mind:

- The impact on your plan’s fees. If you have a large number of participants, your plan’s fees may be lower. If you lower your participant count, your plan’s fees may increase.

- The impact on your plan’s diversity. If you have a diverse workforce, lowering your participant count could make your plan less diverse.

- The impact on your employees. Some employees may be disappointed if they are no longer eligible to participate in your 401(k) plan. You should communicate with your employees about any changes you make to the plan.

It is also important to remember that any changes made to your 401(k) plan must be in accordance with the plan’s documents and all applicable laws and regulations. You should always consult with a qualified professional before making any changes.

For more information on how to determine if these cost-savings strategies are right for your employee benefit plan, reach out to your Grassi advisor or contact Jaime Rapps, Michele Lindner, or Fiona Cheng of Grassi’s Audit Team.