As the summer months approach and temperatures rise, perhaps the only downside to the improved* weather is rising energy bills. However, thanks to the Inflation Reduction Act of 2022 (“IRA”), signed into law in August 2022, a plethora of incentives make lowering the cost of your (or your tenants’) energy bills more efficient, effective, and economical than ever before.

Specifically of note in the IRA are the expanded Investment/Production Business Energy Tax Credits, Energy Efficient Tax Credit, and the expanded Energy Efficient Commercial Building deduction.

The Investment & Production Tax Credits

Under the Investment Tax Credit (ITC) and Production Tax Credit (PTC), defined by Internal Revenue Code §48, businesses may seek a federal tax credit for investments in the following types of energy property:

|

|

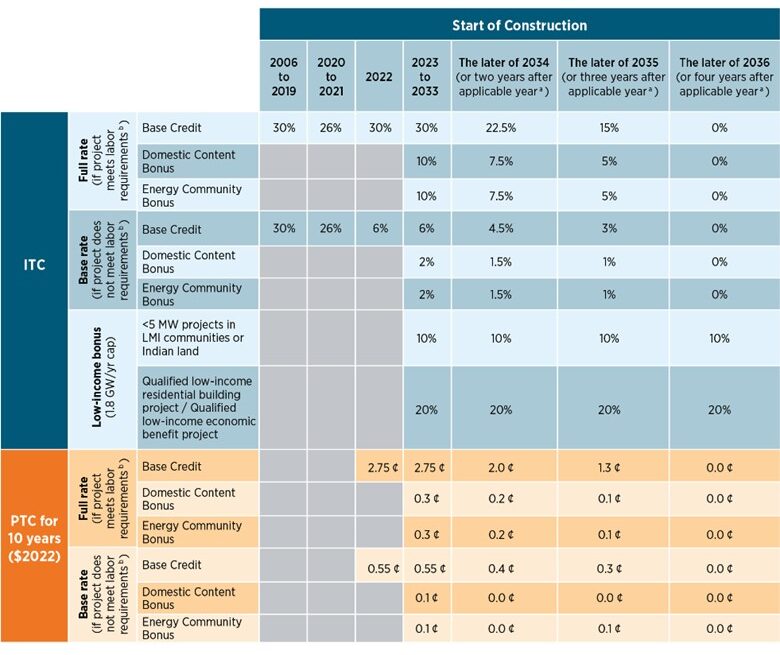

The ITC is an upfront tax credit that does not vary by system performance, while the PTC can provide a more attractive cash flow as the tax credits are earned over time. Choosing the ITC or the PTC depends largely on the project’s cost, the amount of sunlight available, and whether it is eligible for any bonus tax credits.

The ITC, assuming a few other factors are met, is generally equal to 30% of the taxpayer’s basis/cost in the qualifying property. Adding even greater incentives, the IRA contained provisions where bonus factors increase the credit (up to 70%).

These include the 10% domestic content bonus, 10% energy community bonus, and either a 10% bonus for low-income communities or a 20% bonus for affordable housing and low-income economic benefit projects.

Furthermore, following a reduction in the basis of the property for depreciation purposes (by 50% of the credit), the taxpayer could still be eligible to utilize bonus depreciation (80% in 2023) for more robust initial tax consequences and faster payback on investment.

Generally, project owners cannot claim the ITC and the PTC for the same property. However, they could claim different credits for co-located systems, like solar and storage, depending on what further guidance is issued by the IRS.

Bonus Credits

| Category | Amount* for projects less than 1 MWAC (Cumulative) | Amount* for projects greater than 1 MWAC (Cumulative) |

| Domestic content minimums (% attributable to U.S. manufactured products) | ITC: +10%

PTC: +0.3/¢kWh |

ITC: +10%

PTC: +0.3/¢kWh |

| Sitting in an energy community (ex: A Brownfield site, area related to mining operations) | ITC: +10%

PTC: +0.3/¢kWh |

ITC: +10%

PTC: +0.3/¢kWh |

| Sitting in a low-income community or on Indian land (<5 MWAC) | ITC: +10%

PTC: N/A |

ITC: +10%

PTC: N/A |

| Qualified low-income residential building project or economic benefit project | ITC: +20%

PTC: N/A |

ITC: +20%

PTC: N/A |

Suppose you cannot utilize all the credits or have alternative monetization plans. In that case, the IRA allows a taxpayer to transfer all or a portion of the energy tax credits to an unrelated taxpayer as long as the amount paid as consideration is in cash.

Investment Tax Credit (ITC) and Production Tax Credit (PTC) Values over Time

Clean Energy ITC/PTC

Starting January 1, 2025, the IRA replaces the traditional PTC with the Clean Energy Production Tax Credit and the traditional ITC with the Clean Electricity Investment Tax Credit.

These tax credits are functionally similar to the ITC/PTC but are not technology specific. They apply to all generation facilities (and energy storage systems under ITC) with an anticipated zero greenhouse gas emissions rate.

The credit amount is generally calculated in the same manner as described above but will be phased out as the U.S. meets greenhouse gas emission reduction targets.

§45L Tax Credits for Zero Energy Ready Homes

The IRA also amended IRC §45L to provide taxpayers with a tax credit for eligible new or substantially reconstructed homes that meet applicable ENERGY STAR home program or DOE Zero Energy Ready Home (ZERH) program requirements.

The new §45L provisions include two tiers of credits, with the higher credits for eligible homes and dwelling units certified to applicable ZERH program requirements.

The §45L credit is $5,000 for single-family and manufactured homes eligible to participate in the EPA’s ENERGY STAR Residential New Construction Program or the ENERGY STAR Manufactured New Homes Program, respectively, and which are certified to applicable ZERH program requirements.

The §45L credit is $1,000 for dwelling units that are part of a building eligible to participate in the ENERGY STAR Multifamily New Construction Program and which are certified to applicable ZERH program requirements unless the project meets prevailing wage requirements, in which case the 45L credit is increased to $5,000 per dwelling unit.

These new §45L rules apply to qualified energy-efficient homes acquired after December 31, 2022, and before January 1, 2033, for use as a residence during the taxable year.

§179D Energy Efficient Commercial Building Deduction

Lastly, the IRA extended and greatly expanded the §179D deduction for commercial building owners. Under this section, commercial building owners can claim an immediate federal tax deduction for installing energy-efficient equipment in new or existing buildings.

residential projects (of 4 stories or more) are eligible for the §179D deduction (and the aforementioned credit under IRC §45L).

This federal tax deduction, now up to $5 per sq foot, is significantly increased over the previous amount of $1.80 per sq foot and is available for qualifying energy-efficient improvements to a building’s lighting system, HVAC system, and the building envelope.

In addition to building owners, primary designers — including architects, engineers, green building consultants, and contractors — of qualifying energy efficiency measures in buildings owned by the government and nonprofit entities may also claim the deduction.

Furthermore, under the IRA, the threshold for a reduction in energy and power costs has been lowered and now must equal only at least 25% (versus 50% before the IRA passage).

Third-party certification is required to claim the §179D deduction.

With so many credits and incentives available, developers should consult their accountants and advisors during the early stages of any new project. In addition, given the credit availability for retrofitting existing properties, existing owners of already constructed properties would be well-served by exploring whether any IRA provisions make economic sense for them.

*Author dislikes the cold but respects those who enjoy it more than warmer temperatures