Nonprofits are entering 2026 with a renewed focus on how they allocate and invest their resources in a volatile economic environment. Expenses that once seemed routine, such as expanding programs, upgrading technology or hiring staff, now need to demonstrate a clear link to mission outcomes.

Confronted with many difficult trade-offs about where to allocate time, effort, and resources, many organizations are focusing on the initiatives with the most significant impact and scaling back those that do not. By clarifying their financial priorities and strengthening financial management practices, nonprofits can direct resources more intentionally and ensure every dollar spent ultimately reaches the people and communities they serve.

Key Pressures Driving Nonprofit Financial Priorities

The 2025-26 Nonprofit Leadership Report, a survey of more than 200 leaders across the sector, highlights the financial pressures affecting decision-making today. Concerns about the economy have increased significantly, with 44% of leaders expecting it to worsen, up from 28% the previous year.

Nonprofit executives highlighted several challenges influencing these changing financial priorities:

- Rising Costs: Eight in ten organizations reported cost increases, ranging from 13–15%, far above the 2.9% inflation rate.

- Funding Volatility: The funding landscape is unpredictable. While 44% of organizations reported funding increases, 29% experienced decreases.

- Federal Funding Shifts: A majority (56%) depend on federal funding. Among these, “significant reductions” were cited nearly twice as often as “significant increases,” complicating budget planning and cash flow.

In this context, leadership teams are reassessing how to deploy their limited resources and which expenses most effectively advance their mission.

Top Financial Priorities for Nonprofits in 2026

In the report, nonprofit leaders describe where they are actively sharpening their focus in response to these challenges, identifying key areas where they plan to prioritize resources and efforts.

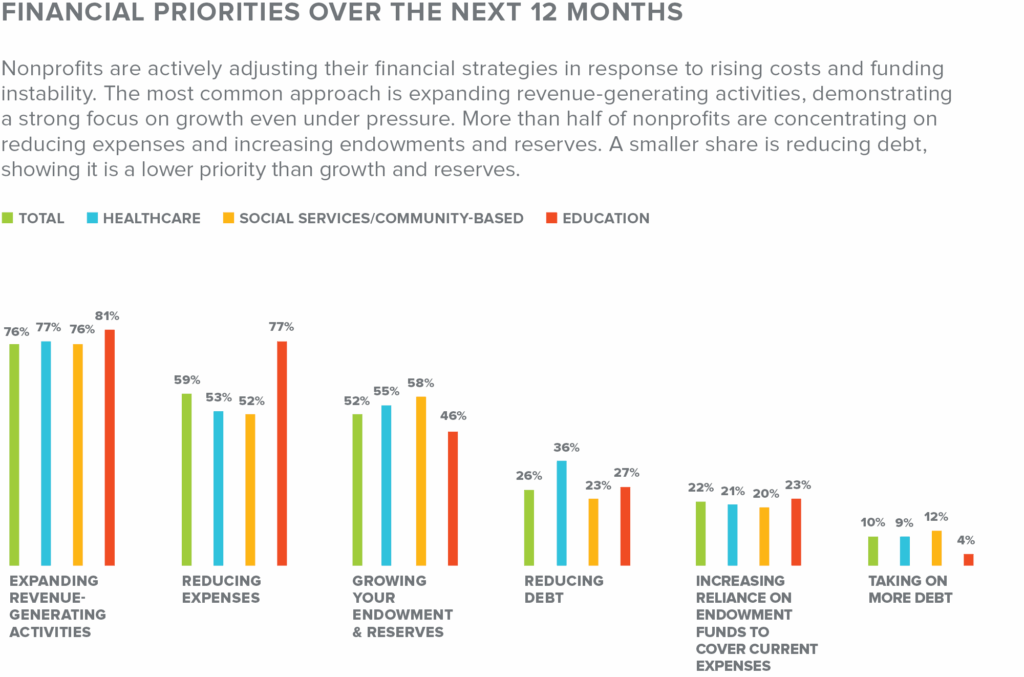

Expanding revenue-generating activities tops the list of priorities for nonprofit leaders in 2026, emphasizing a proactive approach to navigating financial challenges. At the same time, many leaders recognize the importance of managing costs as they turn their focus to reducing expenses. For many organizations, the right strategy will be a mix of both approaches, balancing cost management with strategic investments in revenue generation and mission-critical programs.

Based on responses from nonprofit leaders and financial best practices, here are eight strategies that nonprofits should consider as they engage in priority-setting for 2026:

- Expanding Revenue-Generating Activities

Nonprofits are reducing dependence on unstable funding sources by aligning their strengths with market demand and community needs. Corporate partnerships, expanded offerings and digital-first fundraising initiatives are helping organizations generate steady revenue streams that support their core mission work. - Reducing Expenses through Strategic Cost Review

Leadership teams are reevaluating how to allocate limited resources and right-sizing their spending to match current needs. They are carefully reviewing their budgets, identifying redundancies and leftover expenses from high-growth phases.Key cost areas to re-examine include:- Human Capital Costs: With salaries often lagging private sector rates, regular reviews of compensation and benefits help balance sustainability with employee well-being and retention, a top priority for 62% of leaders.

- Utilities and Recurring Costs: Ongoing expenses such as utilities, software subscriptions and maintenance should be assessed to confirm that resources are being deployed intentionally and efficiently.

- Centralized Administration: Evaluating whether administrative or program functions can be consolidated helps reduce redundant spending and allows staff to focus more fully on mission-driven work.

- Events: Investments of time, staff capacity and budget should be directed toward events that offer a clear return, whether through revenue generation, donor engagement or measurable community impact.

- Growing Reserves and Using Debt Strategically

Building a healthy operating reserve (ideally, three to six months of expenses) is a top priority for many organizations, providing a critical buffer against disruption. Leaders are also engaging in thoughtful discussions about how to leverage debt strategically to support the infrastructure improvements and program expansion that generate revenue. - Implementing Rolling Forecasts and Scenario Planning

With economic uncertainty ranked as a top concern, static annual budgets limit an organization’s ability to respond to evolving conditions. Rolling forecasts and scenario planning allow nonprofits to update assumptions throughout the year, improve financial visibility and maintain alignment between resources and priorities. - Strengthening Technology and Data Infrastructure

As organizations seek to expand capacity and efficiency, 48% are investing in advanced data analytics and AI. Integrated systems that automate tasks, improve data visibility and support informed decision-making drive efficiencies, increase productivity and enhance the organization’s ability to measure and demonstrate impact. - Partnering and Collaborating for Greater Efficiency

To reduce overhead and expand collective impact, organizations are forming partnerships with those that share complementary missions or audiences. Collaboration may include co-delivering programs, sharing administrative functions or pursuing joint funding opportunities. - Exploring Outsourced Expertise

With 62% of leaders prioritizing talent recruitment and retention, outsourcing specialized functions such as finance, HR, and IT allows nonprofits to access senior-level expertise without the cost of full-time staffing. Fractional CFOs provide high-value guidance in forecasting, scenario planning and financial reporting, helping organizations improve financial discipline and performance. - Benchmarking and Refining

More than half of organizations now use comparative data to evaluate effectiveness. Regular reviews of liquidity, reserves and administrative ratios support ongoing improvements and help leaders gauge progress over time. This commitment to continuous refinement ensures that financial strategies remain aligned with mission, values and long-term goals.

Financial Decision-Making, Anchored in Mission

The north star of any nonprofit’s financial priorities should be alignment: the connection between what the organization does best, what generates consistent funding and what most powerfully advances the mission. When every financial decision is viewed not as a series of isolated choices, but as an ongoing process of aligning resources with mission, nonprofits can navigate today’s challenges with confidence and keep the work centered on the people and communities they serve.

Discuss Your 2026 Strategy with Grassi’s Nonprofit Advisors

Grassi’s Nonprofit team is available to help your organization fulfill its mission and thrive in 2026. To discuss the results of the 2025-26 Nonprofit Leadership Report, or to learn how financial, operational, governance and technology solutions can help strengthen your organization today, reach out to David M. Rottkamp or a Grassi advisor today.

Frequently Asked Questions

What are the top financial priorities for nonprofits in 2026? Nonprofits are prioritizing revenue generation, strategic cost management, reserve building and stronger financial forecasting. Many are also focusing on technology upgrades, outsourced CFO expertise and partnerships that improve efficiency

Why are financial reserves significant for nonprofits? Financial reserves provide stability during economic volatility and funding shifts. Many leaders aim for three to six months of operating expenses to safeguard programs, manage cash flow and support other strategic priorities.

How can nonprofits reduce expenses without weakening their mission? Strategic cost reviews help organizations develop their budgets, eliminate redundancies, reassess staffing and administrative needs, and ensure that spending directly supports mission outcomes. This includes reviewing utilities, subscriptions, events, and centralized administrative functions.

How can Grassi support nonprofits with 2026 financial planning? Grassi’s Nonprofit advisors specialize in financial, operational, governance and technology solutions that help organizations strengthen financial practices, align resources with mission and plan for long-term sustainability.