The 2020 year-end is rapidly approaching with an $11.58 million per taxpayer lifetime gift and estate tax exclusion and historically low interest rates. The confluence of these circumstances has caused many business owners to consider selling their businesses, taking on new investors, or gifting assets or ownership interests to younger family and management generations.

But if the business obtained a Paycheck Protection Loan (PPL), there are some factors that must be considered before these year-end gifting or business strategies can be effectuated.

The CARES Act neither contemplated nor addressed how PPLs are treated with respect to transferring a borrower’s business assets or ownership interests. Some lenders addressed this in their loan documents by preventing an assignment of ownership interests or transfer of borrower assets without the lender’s consent. The SBA itself did not address this topic until it issued Notice 5000-20057 – taking borrowers, lenders, and us by surprise.

The Unintended Consequences

As Grassi’s Emergency Loan Consultants reported this fall, the Notice provides that if a PPL borrower transfers ownership interests or assets exceeding specified thresholds, the borrower must obtain the SBA’s consent, provide additional documentation, and possibly put the PPL funds into an escrow account.

These restrictions apply even if the borrower spent all the PPL funds on permitted expenses that presumably would result in full forgiveness. And they also apply when gifting or transferring business interests to family and others.

The Notice provides that the transfer restrictions apply until the note is “fully satisfied,” which means meeting one of the following requirements:

- The borrower has repaid the PPL in full;

- The loan is forgiven (i.e.: The SBA has remitted funds to the lender in full satisfaction of the note, which could take as long as 150 days); or

- The borrower has repaid any remaining balance on the PPP note after the SBA remits funds to the lender as part of the loan forgiveness process.

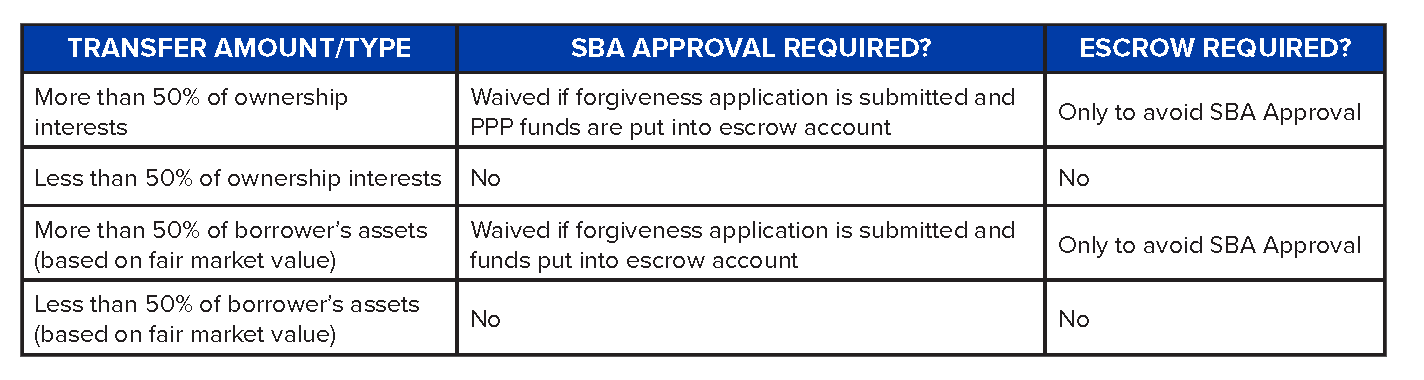

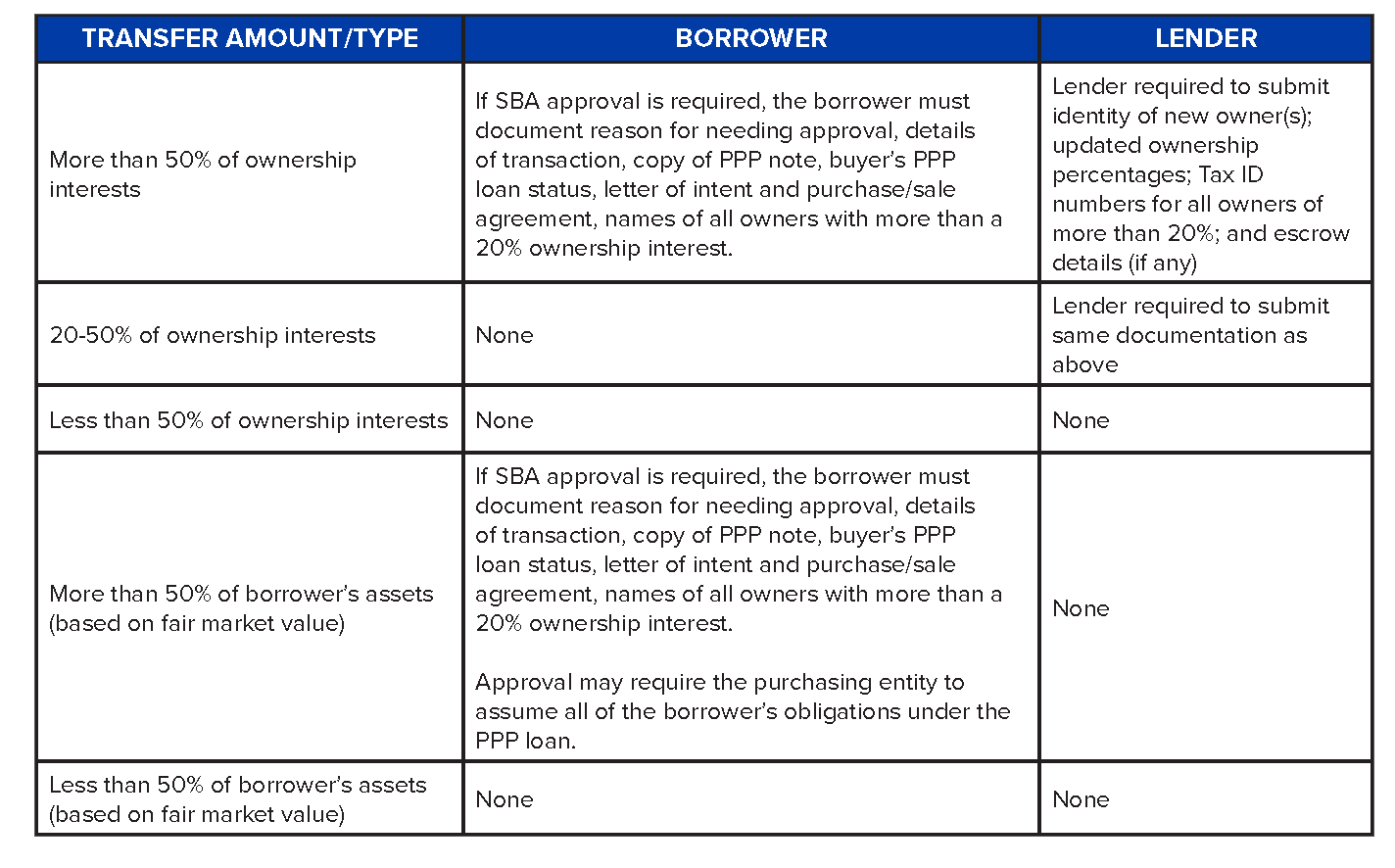

The Notice outlines the SBA’s approval, escrow and documentation requirements that certain borrowers must meet prior to the transfer of assets or ownership interests. The requirements vary based on transfer amount and type and are laid out in the tables below. The SBA has 60 days to review and approve a transfer – a longer amount of time than what is left of 2020.

Note: The below requirements are in addition to any lender approval requirements included in your loan documents.

Table 1. SBA Approval and Escrow Requirements

Table 2. SBA Documentation Requirements

Managing the Unintended Consequences

An unintended PPL consequence should not keep taxpayers from reaching their estate or tax planning objectives. In other words, do not let the PPL tail wag the economic dog. Even with the SBA’s restrictions and year-end time constraints, there are options available for PPL borrowers who want to sell interests, take on new investors or transfer ownership to family and management generations by year-end. The options available depend on an owner’s desires, an entity’s tax species and the type of interest being transferred.

Time is running out, so call your Grassi advisor to discuss your unique situation and the options available to you. If you have already undertaken a transfer that is subject to these rules, it is imperative that you contact your advisor to discuss what must be done to come into compliance.

Grassi’s Emergency Loan Consultants are also available through our Crisis Response & Recovery hotline to guide you through this process.